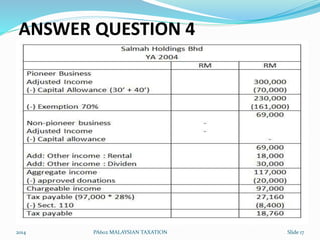

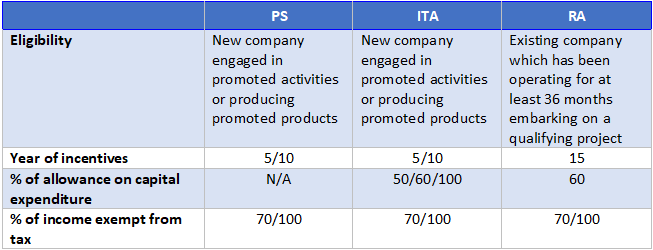

Nevertheless a company eligible for a certain tax incentive might only pay an average effective tax rate of 75 with only 30 of the companys profit being subjected to tax. This article is relevant to candidates preparing for the Advanced Taxation ATXMYS exam.

Do You Run Or Own A Green Penang Green Council Facebook

This is also in-line with the Malaysias commitment to reduce 45 of Green House Gas GHG emission intensity by 2030.

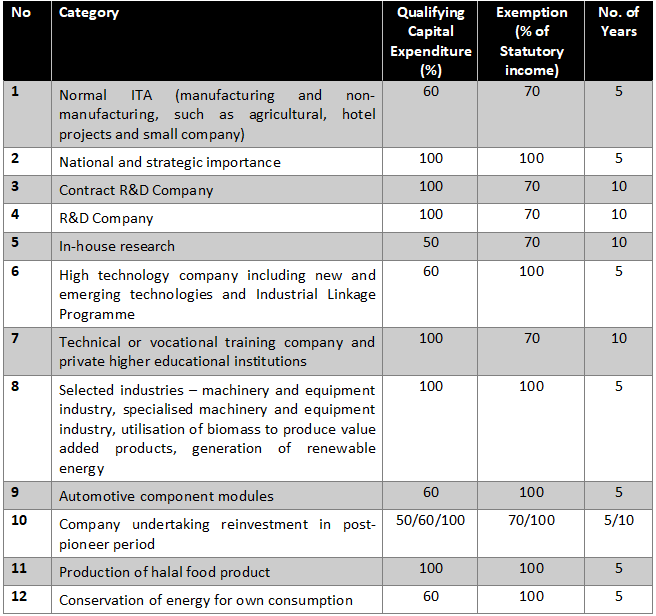

. Investment tax allowance Reinvestment allowance Contract RD company RD company etc. Among the various types of tax incentive available upon making. Import duty exemption on raw materials components.

Benefits of Investment Tax Allowance. Investment Tax Allowance. Statutory Income SI 60 multiply by capital expenditure restricted to 70 of SI exempt income.

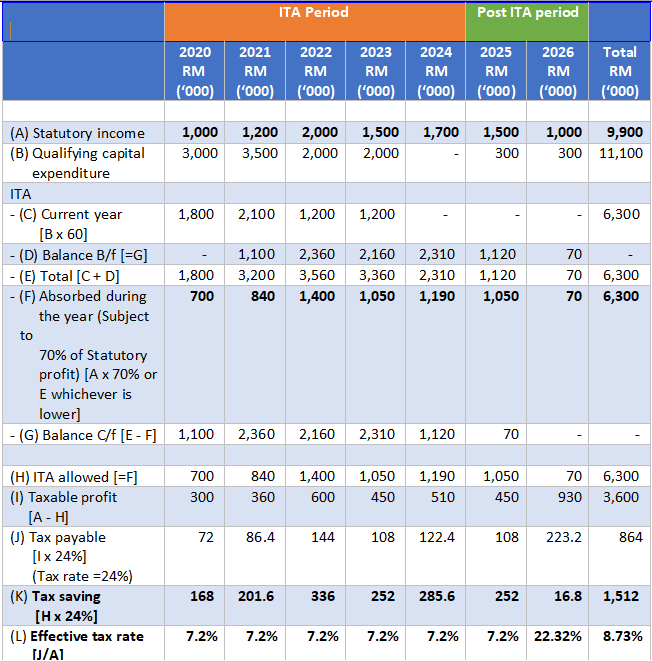

Green Investment Tax Allowance GITA - Project 11 Green Investment Tax Allowance of 100 of qualifying capital expenditure incurred on green technology project for three 3 years. Investment Tax Allowance of up to 100 on qualifying capital allowance for a period up to 10 years. Manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of its profits are subject to tax.

Corporate - Tax credits and incentives. Latest Updates on Reinvestment Allowance. The Green Investment Tax Allowance GITA assets are for companies that obtained qualifying green technology assets.

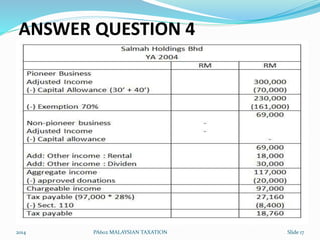

The companies in Malaysia should minimize the deterioration of the environment or reduce greenhouse emissions. As an alternative to Pioneer Status a company may apply for Investment Tax Allowance ITA. A high technology company qualifies for investment tax allowance of 60 of qualifying capital expenditure incurred within five years from the date the first capital expenditure is incurred.

The Malaysian government extends a full tax exemption incentive of fifteen years for firms with Pioneer Status companies promoting products or activities in industries or parts of Malaysia to which the government places a high priority and ten years for companies with Investment Tax Allowance status those on which the government. Or those undertaking qualifying green technology projects for business or own consumption may apply to the Green Investment Tax Allowance GITA. Also 100 of the ITA on QCE has to be offset within 5 years against 1005 of the statutory income they earn.

Last reviewed - 14 December 2021. Pioneer status investment tax allowance and reinvestment allowance. 80 multiply by capital expenditure restricted to 85 of SI exempt income.

Where incentives are given by way of allowances any unutilised allowances may be carried forward indefinitely to. The main tax incentives available in Malaysia include pioneer status an exemption based on statutory income and investment tax allowance based on capital expenditure. A 100 investment tax allowance for five years for existing companies in Malaysia that relocate their overseas manufacturing facilities to Malaysia.

The tax rate is concessional at 20 of the statutory income derived. Investments below RM5000 are not eligible for the tax incentive. Generally tax incentives are available for tax resident companies.

Malaysia has a wide variety of incentives covering the major industry sectors. Income tax is an important factor that needs to be taken into consideration in the planning of investment in Malaysia as this will affect the return on investment and if not properly plan can have a significant negative impact on the return. Tax incentives can be granted through income exemption or by way of allowances.

Year 2 - Claim tax deduction during filing of tax returns for year 2 Accredited angel investors must hold not more than 30 of the issued of shared capital of the investee company. The allowance can be offset against 70 of statutory income in the year of assessment. The objectives of the incentives are.

Claims can only be made up to the maximum of RM500000. In Malaysia tax incentives both direct and indirect are provided for in the Promotion of Investments Act 1986 Income Tax Act 1967 Customs Act 1967 Excise Act 1976 and Free Zones Act 1990. To take advantage of this tax allowance companies should comply with all the following requirements.

Service tax is levied at 6 percent on taxable services provided by prescribed taxable persons. While pioneer status is an income-based tax incentive investment tax allowance is a capital expenditure-based. This article collates and discusses the provisions in the Income Tax Act 1967 the Act and the Promotion of.

In Malaysia the corporate tax rate is now capped at 25. In Malaysia and that make a minimum investment in fixed assets of MYR 300 million are eligible for the incentive 0 special tax rate if certain conditions are fulfilled. The article is based on the prevailing laws as at 31 March 2018.

Investment Tax Allowance ITA. Up to 10 years for new companies and up to 5 years for expansion projects 100 exemption is provided from the year they start generating statutory income. Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions.

The Green Income Tax Exemption. Proactive planning to maximise tax Pioneer status and investment tax allowance are two of the main tax incentives available in Malaysia. Pioneer status often provides a 70 exemption of statutory income for a period of 5 years.

The allowance can be utilised to offset. Based on the Finance Act 2021 which was gazetted on 31 December 2021 the Special RA is extended for an additional two 2 years to YA 2024. Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA.

THK Management Advisory Sdn Bhd - Investment Tax Allowance Incentive Malaysia - Jun 08 2022 Johor Bahru JB Malaysia Taman Molek Service THK Management Advisory - Our accounting firm specializes in company secretarial practice HR payroll services outsourced bookkeeping and accounting services. Extension of Special RA. In tandem with the Malaysian Governments agenda to drive the growth of Malaysias green economy the Green Technology Tax Incentive was introduced in 2014.

Unutilised allowances can be carried forward until they are. On taxable goods manufactured in Malaysia or imported into Malaysia. Any unutilised allowance can be carried forward to subsequent years until the whole amount has been fully utilised.

Green Investment Tax Allowance GITA of 100 of qualifying capital expenditure incurred on approved green technology assets from the date of purchase until 31 December 2020. The following table illustrates the eligibility period for RA claim for companies which have exhausted the initial 15 years of RA period. All investment must be made in cash in.

The Rate of Incentive. The computation of ITA for a Year of Assessment is as follows -.

Budget 2019 The Proposed Tax Changes That The Business Must Know Cheng Co Group

Chapter 5 Investment Incentives

How Does The Green Investment Tax Allowance Gita Work Solarvest

Tax Incentives For Green Technology In Malaysia Gita Gite Project

Malaysian Companies Solar Tax Incentives By Helmi Medium

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

How To Calculate Capital Allowance In Taxation Malaysia Gabrieltrf

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Tax Incentives For Research And Development In Malaysia Acca Global

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

The Green Investment Tax Allowance Gita Maqo

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

How Does The Green Investment Tax Allowance Gita Work Solarvest

Net Energy Metering Schemes Solar Sunyield

Tax Incentives For Research And Development In Malaysia Acca Global